Finland’s economic upswing to strengthen in 2025

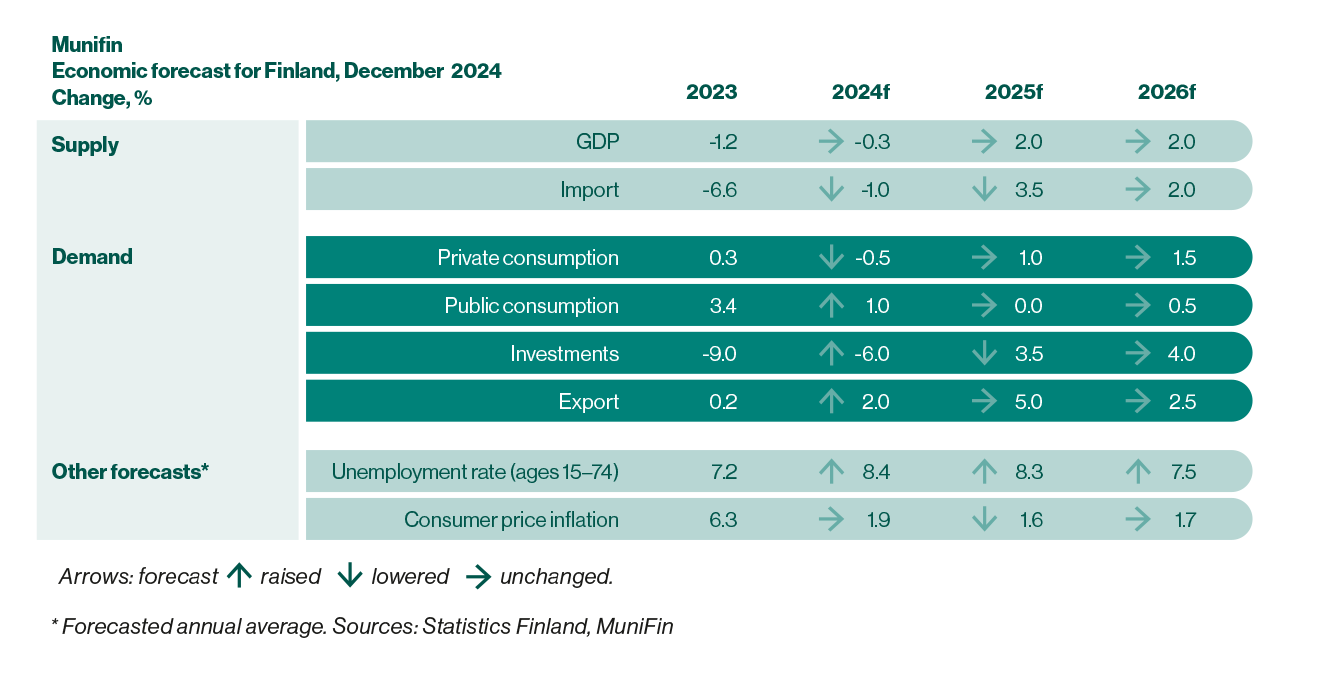

The domestic economy is expected to pick up pace next year as both consumption and investments improve. The most significant uncertainties relate to the unexpectedly weak development of employment.

The latest GDP figures confirm that a turnaround has occurred in the Finnish economy. GDP has grown in every quarter of the current year. However, the recovery is still narrow based. Growth has so far been supported mainly by net exports and public investment. In contrast, domestic private demand factors remain weak.

“The most worrying situation is in private consumption, which was expected to be the main driver of the upswing. This doesn’t seem to be the case yet. The rise in living costs and interest rates experienced in recent years has had a longer-lasting impact than anticipated. Although purchasing power has already started to improve and interest rates are falling, the decline in employment, benefit cuts, and the increase in the general value-added tax rate have prolonged the consumption slump,” comments Timo Vesala, Chief Economist at MuniFin.

Although the domestic market situation is more difficult than expected and consumer confidence is low, growth expectations in the corporate sector have already started to strengthen. As the positive and negative surprises in the economic development have been more or less balanced, MuniFin does not at this stage see a need to change its GDP forecast for the coming years.

“The starting position for next year is clearly better. In addition to export-driven growth, investment and consumption will also start to generate growth. Thanks to the broadening base of the recovery, two percent GDP growth in 2025–26 is still a realistic estimate,” Vesala continues.

The risks associated with the forecast have nevertheless increased. Domestically, the most significant uncertainties relate to employment.

“The real cornucopia of risks, however, is the unpredictability of the international economy and politics,” Vesala notes.

The markets expect the ECB to lower its deposit rate to below two percent fairly quickly next year.

“Eurozone inflation has slowed down promisingly, but protectionism and potential new geopolitical crises can still disrupt global supply chains and increase production costs. Due to these risks, the ECB may ultimately decide to lower interest rates less than the market expects,” says Vesala.