MuniFin started the new year strong with a record-breaking benchmark. The EUR 1.25 billion 5-year transaction attracted outstanding investor demand amounting to a final order book of EUR 7.1 billion (excl. JLM), representing the largest one for MuniFin to date. In a busy January market, this is a remarkable first step to fulfill the funding target of EUR 9 billion for 2025.

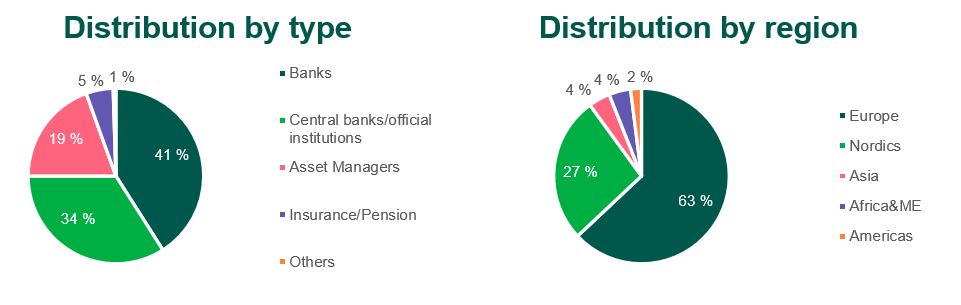

The books initially opened with guidance at MS+35bps but were revised twice before being finalised at MS+31bps. High-quality order book attracted strong interest, particularly from banks, which received 41% of the allocations. Central Banks and Official Institutions followed, taking 34%. Geographically, the majority of the allocations went to Europe (63%), with the Nordics receiving 27%.

“What a fantastic way to kick off our benchmark funding for the year! With a record orderbook of EUR 7.1 billion and more than 120 investors participating, EUR market is very strong and remains in the heart of our funding strategy. We want to thank our lead managers for the work and investors for their continued trust in MuniFin”, says Antti Kontio, Head of Funding and Sustainability at MuniFin.

Joint lead managers of the transaction were CACIB, Citi, Danske Bank and LBBW.

Final terms

| Issuer | Municipality Finance Plc (“MuniFin”) |

| Issue rating | Aa1 / AA+ (Moody’s / S&P) (all stable) |

| Issue amount | EUR 1,250,000,000.00 |

| Pricing date | 21 January 2025 |

| Settlement date | 28 January 2025 |

| Maturity date | 14 December 2029 |

| Re-offer price / yield | 99.737% / 2.684% |

| Annual coupon | 2.625% (short first coupon) |

| Re-offer spread | Mid-swaps +31bps |

| Spread vs benchmark | OBL 2.5 Due October 2029 +38.4bps |

| ISIN | XS2988555855 |

| Joint lead managers | CACIB, Citi, Danske Bank, LBBW |

Comments from joint lead managers

“Many congratulations to the MuniFin team for an exceptionally strong return to the EUR market. Credit Agricole CIB was delighted to support this successful first EUR benchmark of 2025, which attracted record investor demand without paying any new issue concession over its fair value. The quality, diversity, and oversubscription of the orderbook highlights MuniFin’s strong standing amongst the EUR investor base. A fantastic result!”

Lawrence Duquesne-Garner, Managing Director, SSA DCM Origination, Credit Agricole CIB

“Many congratulations to the MuniFin team for their first EUR benchmark transaction of 2025! The final orderbook in excess of EUR 7 billion, MuniFin’s largest ever, was a demonstration of MuniFin’s credit strength and on-going popularity with the SSA investor base. Over 140 investors participated from 27 different countries, an impressive investor distribution. Citi is delighted to have been part of this stellar transaction.”

Ebba Wexler, Head of SSA DCM, Citi

“We congratulate Munifin with their very successful 5y transaction which attracted the largest EUR orderbook for Munifin ever. The new bond was priced at fair-value and displays the strong following for the name and the tenor. It also demonstrates the current strength of the primary SSA market with a very strong orderbook. “

Bo Søndergaard, Head of SSA, Danske Bank

“MuniFin deserves nothing but praise for having successfully executed their 2025 opening EUR benchmark. Raising EUR 1.25bn in 5 years, the leading Nordic SSA issuer managed to record impressive investor demand of more than EUR 7bn. This reflects both, the right funding strategy and MuniFin’s dedicated role as foundation of the Finnish welfare society and driver of the green transformation. LBBW’s team congratulates MuniFin and is proud having contributed towards this strong outcome.”

Patrick Seifert, Head of Primary Markets & Global Syndicate, LBBW

Further information

Joakim Holmström

Executive Vice President, Capital Markets and Sustainability

+358 50 444 3638

Antti Kontio

Head of Funding and Sustainability

+358 50 370 0285

Lari Toppinen

Manager, Funding

+358 50 407 9300

Aaro Koski

Senior Analyst, Funding

+358 45 138 7465