The economy may recover quickly in 2024, but negative risks to the economic outlook are also increasing

The recession will persist in Finland through the winter, but recovery is expected to begin in 2024, driven by domestic demand.

In the latter half of this year, the Finnish economy is heading towards a recession. GDP declined by 0.9 percent in the third quarter. Consumer confidence and business sentiment indicators have remained exceptionally low throughout the autumn, suggesting that the economic contraction is likely to persist into the final quarter of the year.

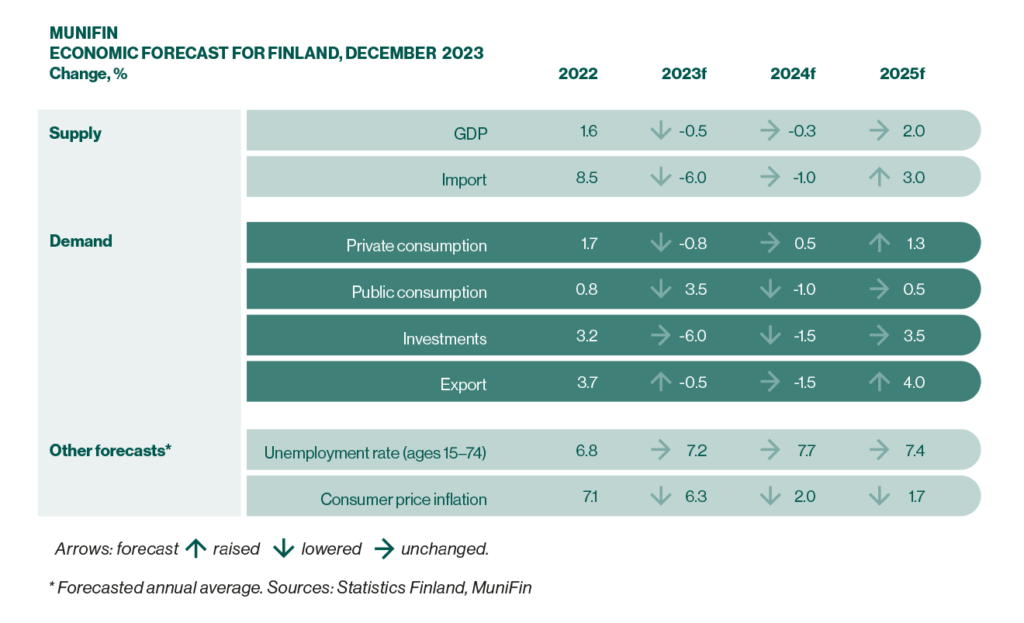

The economic development in the fall has, broadly speaking, followed MuniFin’s expectations. However, due to data revisions, MuniFin is lowering its GDP forecast for the current year to -0.5%, compared to the previous forecast of -0.3% in September. Meanwhile, GDP projections for the next few years remain unchanged at -0.3% for next year and +2% for 2025.

“The combined negative impact of factors burdening the economy will be strongest during this winter. We expect a positive turn to occur around the middle of next year”, says Timo Vesala, Chief Economist at MuniFin.

The unemployment forecast remains unchanged, despite the employment situation worsening slightly more than expected this year. On the other hand, consumer price inflation seems to be slowing down somewhat faster than MuniFin’s previous estimates. According to the new forecast, the average inflation rate for 2023 is still expected to reach 6.3%, but it will decrease to 2.0% next year and 1.7% in 2025.

“While changes to macroeconomic forecast figures are mostly technical adjustments, the risks to the economic outlook have increased. The final depth of the recession in the construction sector and its potential spillover effects on other industries are difficult to assess, and there is still uncertainty regarding the inflation outlook in the eurozone”, Vesala assesses.

“On the other hand, a recovery faster than our baseline forecast is entirely possible. In the best-case scenario, a decline in interest rates could strengthen demand more significantly and broadly than expected, leading to an unexpectedly sharp economic upturn.”