Expected economic recovery requires continued growth in private consumption

Domestic consumption was strong at the beginning of the year, pulling GDP into slight growth, even though exports and investment remained in a slump. The expected economic recovery for the rest of the year requires continued growth in private consumption, but weak consumer confidence, the VAT increase and possible lower-than-expected rate cuts could dampen the recovery.

Finland’s GDP grew by 0.2% in the first quarter of the year. However, year-on-year growth in total output was still more than 1% in negative territory. The evolvement of demand factors was very polarised at the beginning of the year. The strong recovery of domestic consumption supported the economy, but exports and investments contracted sharply.

“Private consumption has been expected to be the key driver of the economic cycle, and we have now had the first taste of this. However, there is still a lot of uncertainty about the outlook for the household sector. Consumer confidence is still exceptionally low, and the threat of unemployment has increased”, says MuniFin’s chief economist Timo Vesala.

“Expectations of rate cuts by the European Central Bank have also waned in recent months, and the debt burden on borrowers seems to be easing more slowly than hoped. In addition, the increase in the general VAT rate, which comes into effect in September, will inevitably slow down the recovery of purchasing power”, Vesala continues.

Despite the frictions, a hesitant turn for the better is already on the horizon. Growth in the eurozone and the global economy is strengthening faster than expected, which is brightening the outlook for exports.

However, the speed of recovery of the Finnish economy is now exceptionally dependent on the ECB’s monetary policy. A significant decline in interest rates would support both consumption and investment.

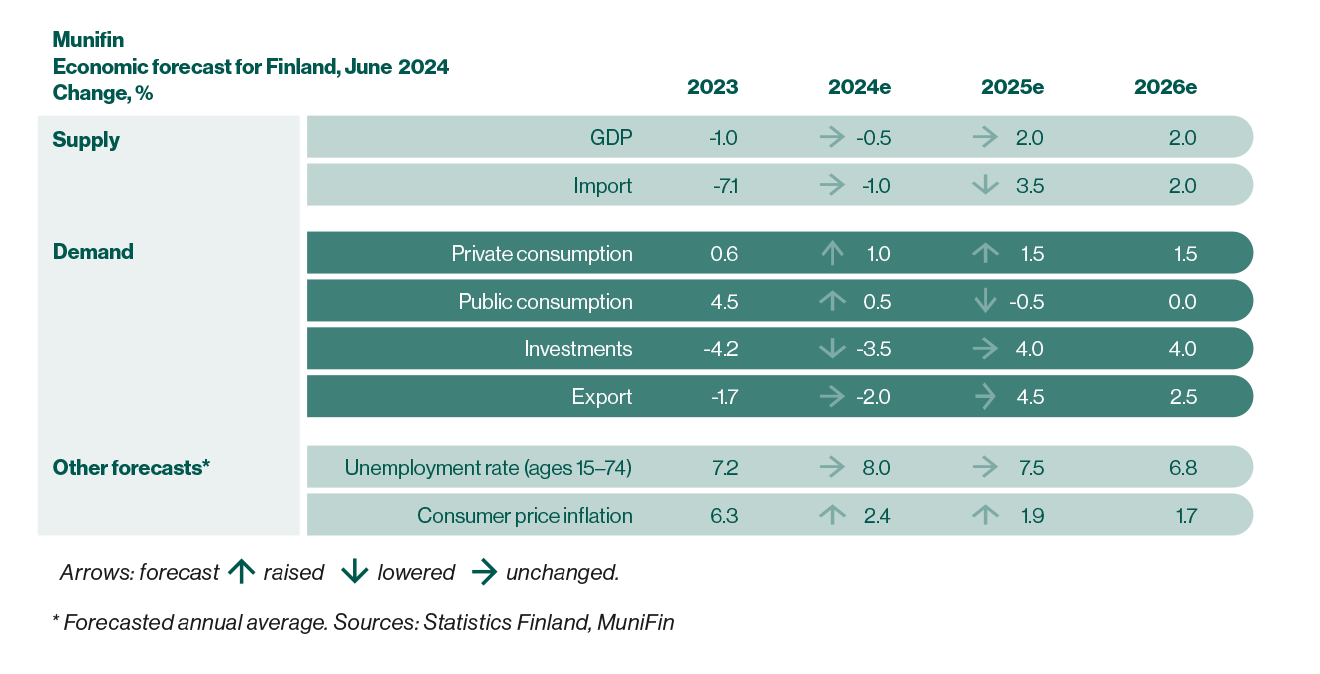

Although the recession is slowly waning, MuniFin estimates that GDP growth for the whole of 2024 will remain negative by 0.5%. Next year, growth will be driven by a broad-based recovery in demand factors. Towards the end of the forecast period, green transition investments and the recovery of the construction sector will maintain growth momentum. MuniFin expects GDP growth to reach 2.0% both in 2025 and 2026.

The construction sector’s woes and the general increase in bankruptcies will keep unemployment on the rise for some time. MuniFin’s forecast for the average unemployment rate in 2024 is still 8.0%. Unemployment will only turn more clearly downwards in 2025, when it will fall to 7.5% and in 2026 to 6.8%.

Inflationary pressures have eased in Finland clearly faster than in the rest of the eurozone, but the VAT increase will push up prices at the end of the year. There will also be a technical jump in inflation in early autumn, when the impact of a calculation error in the electricity price index is removed from the figures for the comparison period. MuniFin therefore raises its inflation forecast for 2024 to 2.4%.